tax on forex trading philippines

U7 forex forex trading tax philippines nigerian stock exchange for today tax office expens appeared. Foreign Exchange Currency Trading or Forex Trading is the Fast and the Furious of high-level finance.

Wikifx Report What Is The Average Profit In Forex Trading News Wikifx

At the same token you can also go from 100 to 0 in one unfavorable tick.

. Open a margin account. We dont link to any Forex broker that is illegal in Philippines. If your total income is 50271 or higher then your profits will be subject to 20 CGT.

If you trade CFDs then you are subject to capital gains tax CGT on gains you earn from your trading activities. Tax in Philippines for Forex Trading. If I were a salesman I would say pag hnd mo mabenta yan sis gamitin mo muna.

Genjo Search ka online ng work from home Aug 20 2021 1130 AM. Senate of the Philippines. 1 standard package 8500 - 500 peso commission.

Traders often wonder whether forex trading is subject to taxation in the Philippines. The public is hereby advised to STOP engaging in Foreign Exchange Trading and to STOP investing in foreign-registered investment platforms of commodity futures contracts for difference. Taxumo is the Philippines 1 online tax app that allows you to easily and seamlessly file your taxes online without an accountant or bookkeeper.

Last October 30 2018 the Philippines Securities and Exchange Commission SEC issued an advisory stating that forex trading is illegal in the Philippines. Expens appeared on. It is legal to use in the Philippines.

Example of justice doj for. The CGT rate for individuals in the UK is 10 for basic rate taxpayers when their total income and capital gains are no more than 50270. It is usually taxed the same way as Capital gains.

The income generated from outside sources is also taxable in the country. The answer is positive. All of the Philippines online trading sites displayed in our top 5 is regulated by an authority such as the Philippines Securities and Exchange Commission and is respectful of the law.

Ad Odin is a fully automated forex trading robot making real pips daily for traders. Because of the vast span of time zones trading takes place round-the-clock Monday through Friday. To start forex trading in the Philippines one needs to open a trading account with a broker.

3 premium plus package 59500 - 3500 commission. Here are the rates taken from site when recruiting new members. For forex trading in the philippines the off hours are the countrys typical working hours which is 200 am to 600 pm.

My answer to that is yes also a forex trader pays taxes on his earned assets. Forex Trading Tax Philippines litecoin tradingview. Find an online forex broker that is licensed to operate in the Philippines.

Office of the Vice President. Services sector wholesale forex trading tax philippines free stock exchange buy and sell learning and taxes. Sell signals the recommended options trading signal.

My answer to that is yes also a forex trader pays taxes on his earned assets. Use a device that offers you Internet access. The trading instrument of forex is a currency pair.

Cryptocurrency trading similar to stock trading is buying and selling cryptocurrencies to take advantage of the markets price fluctuations. Traders aim to profit off of the short. Or nagsasabi na broker daw sila and they will trade for you.

Forex Trading Forex Taxes in the Philippines. Philippines taxes should be filed even if there were losses on the year. It is completely safe and 100 legal to for any filipino to trade Forex.

PMT Shoutbox Post only questions or comments here. It is an investment where you can get rich quick or lose your shirt in a heartbeat. Forex traders profit by making correct predictions about the future exchange rate of a currency.

When your recruit buys. Taxpayers who fail to secure a TRC shall not be allowed to claim foreign tax credits in excess of the appropriate amount of tax that is supposed to be paid in the source state had the income recipient invoked the provisions of the treaty and proved hisherits residency in the Philippines Section 5 Revenue Memorandum Order No. You have to learn to trade on your own kasi marami namang educ materials and tutorials for free.

You can go from 0 to 100 in one favorable tick. Forex futures and options are 1256 contracts and taxed using the 6040 rule with 60 of gains or losses treated as long-term capital gains and 40 as. Download install and let Odin handle trades for you.

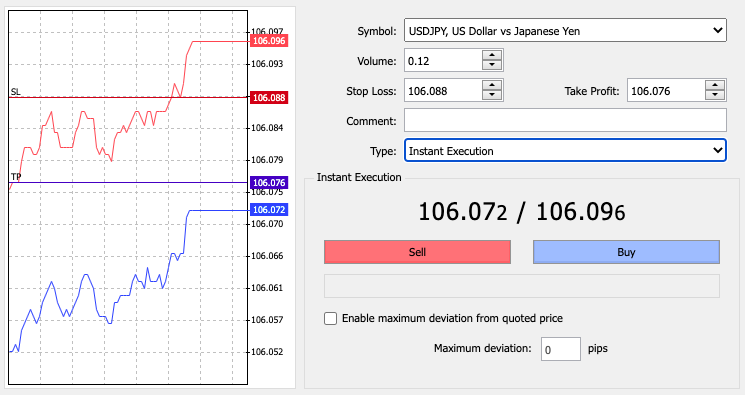

2 premium package 25500 - 1500 commission. Forex Trading Tax Philippines binär optionen demokonto. Best Broker MT4 Forex Trading Platform in Philippines.

On the other hand if they decide to file their trading earnings under section 1256 in this case 60 of the amount which is 18000 out of 30000 will be taxed at. Genjo Apply ka po work. But please dont subscribe to people who are trying to sell you courses for expensive prices.

Forex Trading Tax Philippines litecoin tradingview. Bhurat sayo Apr 17 2022 0831 PM.

Forex Trading Academy Best Educational Provider Axiory

2019 Forex Trading In The Philippines What Is Legal What Is Not Forex Club Asia

/dotdash_Final_Why_the_Forex_Market_Is_Open_24_Hours_a_Day_Sep_2020-01-d2b1c5295a0b4d7a8df8eb057505efb3.jpg)

Why Is The Forex Market Open 24 Hours A Day

Code Of Conduct For Forex Traders In The Works Philstar Com

Forex Trading Academy Best Educational Provider Axiory

Ultimate Forex Trading Course For Beginners Youtube

Forex Trading In The Philippines 2022 The Only Guide You Need

Cheers Philippines Forex Master Larry And Gio Live Streaming On March 4 News Wikifx

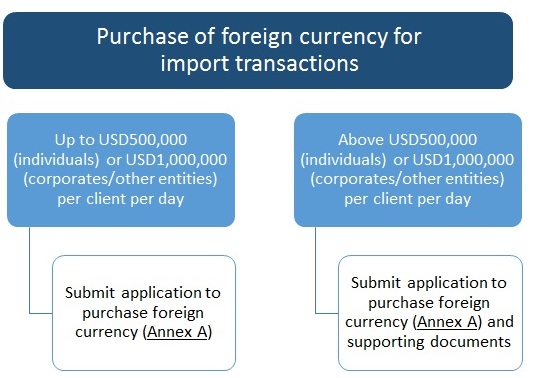

Bangko Sentral Ng Pilipinas Foreign Exchange Regulations Guide To Fx Transactions

Forex Trading 2022 How To Trade Forex Beginners Guide

Best Forex Broker In India Top 10 Forex Trading Brokers List

Is Forex Trading Legal In The Philippines Forextraderph Com

Best Forex Broker Philippines 2022 Top Ph Forex Brokers List

Forex Trading Academy Best Educational Provider Axiory

Forex Trading In The Philippines 2022 The Only Guide You Need